|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

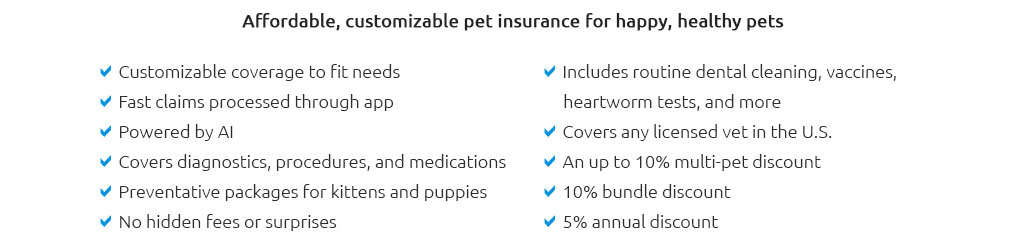

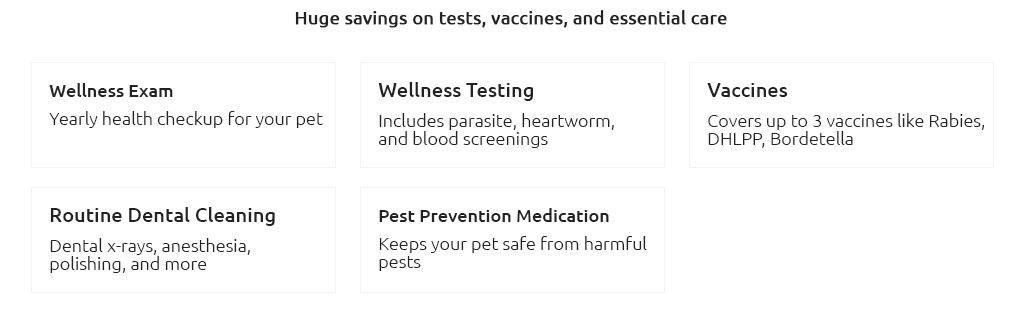

The Average Cost of Pet Insurance: Navigating Available OptionsIn recent years, pet insurance has gained significant traction among pet owners who are keen on ensuring the health and well-being of their furry companions. As with any insurance, understanding the costs involved is crucial for making an informed decision. So, what exactly is the average cost of pet insurance, and what factors should one consider when choosing a policy? First and foremost, it’s essential to acknowledge that pet insurance costs can vary widely, often depending on several variables such as the type of pet, breed, age, and the specific coverage options selected. On average, pet insurance premiums for dogs tend to range from $30 to $50 per month, while cats typically cost slightly less, ranging from $15 to $30 monthly. However, these figures are merely averages and can fluctuate based on the aforementioned factors. One must also consider the type of coverage when evaluating costs. Policies generally fall into three categories: accident-only, accident and illness, and comprehensive plans. Accident-only policies are typically the most affordable, designed to cover unforeseen mishaps like broken bones or accidental ingestion of harmful substances. On the other hand, accident and illness plans cover a broader range of conditions, including common illnesses and chronic conditions, albeit at a higher premium. Comprehensive plans, the most expensive of the lot, often include wellness coverage, dental care, and sometimes even alternative therapies, providing peace of mind for those who want thorough protection for their pets. Another critical factor influencing the cost is the deductible. A higher deductible generally results in lower monthly premiums, but it also means more out-of-pocket expenses when a claim is made. It’s important for pet owners to strike a balance between a deductible they can afford and a premium that fits their budget. Similarly, policy limits and reimbursement levels-typically ranging from 70% to 90% of the vet bill-are significant considerations that affect both premium costs and claim payouts. Breed-specific conditions can also impact insurance costs. Breeds prone to certain hereditary conditions or health issues, such as hip dysplasia in German Shepherds or heart problems in Cavalier King Charles Spaniels, might incur higher premiums. Age is another factor; younger pets generally cost less to insure than older ones, who are more susceptible to illnesses. Beyond the numbers, it’s crucial to read the fine print of any policy. Some policies may exclude pre-existing conditions, while others might have waiting periods for certain types of coverage. Comparing multiple providers and reading customer reviews can also provide insights into the reliability and customer service of the insurance company, which is often as important as the cost itself. While the price of pet insurance can be a concern, it’s vital to weigh this against the potential costs of veterinary care without insurance. Unforeseen medical emergencies can be financially draining, and having a good insurance policy can alleviate this burden significantly. Thus, investing time in researching and understanding the nuances of pet insurance can ensure that pet owners make the best choice for both their finances and the health of their beloved animals. In conclusion, while the average cost of pet insurance might initially seem daunting, a deeper dive into the components that drive these costs can empower pet owners to make informed, strategic decisions. Considering the myriad options available, pet owners are encouraged to evaluate their specific needs, financial situation, and the potential benefits of insurance coverage. Ultimately, the right policy can provide not only financial security but also the invaluable peace of mind that comes with knowing one's pet is protected. https://money.com/how-much-is-pet-insurance/

The average cost of pet insurance for dogs is $53 per month or $640 a year. However, those figures are averages for all insured dogs. Premiums ... https://naphia.org/industry-data/section-3-average-premiums/

2023 Average Premiums (U.S.) ; DOG, Annual: $675.61. Monthly $56.30, Annual: $204.16. Monthly $17.01 ; CAT, Annual: $383.30. Monthly $31.94, Annual: $116.11 https://www.reddit.com/r/petinsurancereviews/comments/1e6tf0y/is_pet_insurance_worth_it_and_how_much_does_it/

You will have to choose a deductible you are comfortable with, I think most people go with $250 or $500 and then also you can choose your ...

|